Double declining method formula

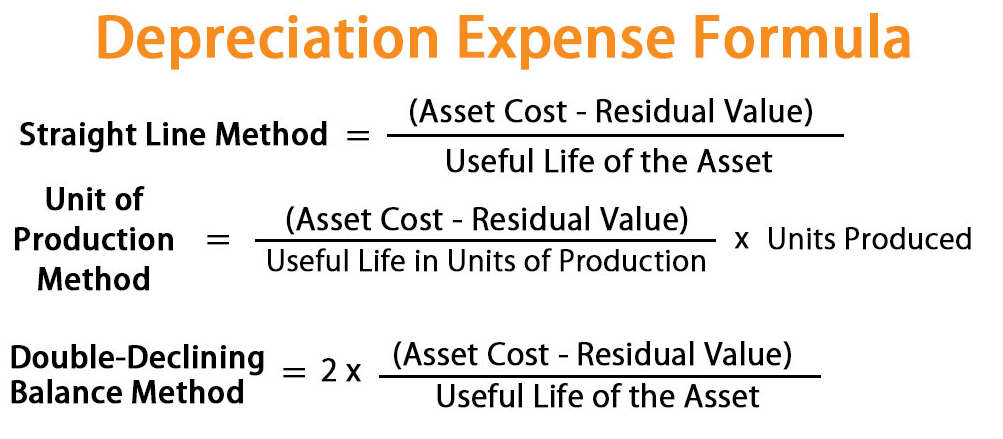

Straight line depreciation rate 15 02 or 20. Heres the formula for calculating the amount to be depreciated each year.

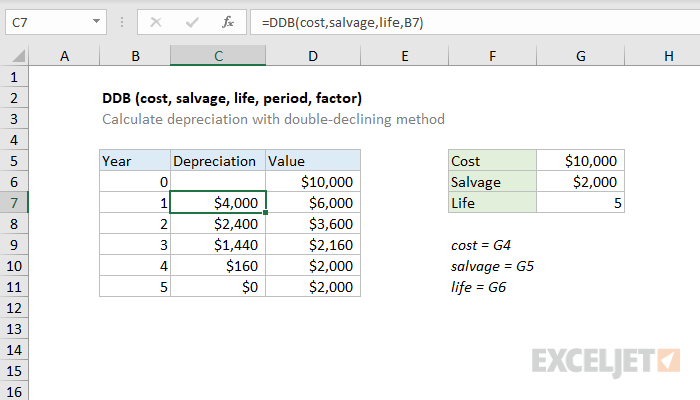

How To Use The Excel Ddb Function Exceljet

Content Double Declining Balance Depreciationdefined With Formula Calculation Examples Example Of Ddb Depreciation Double Declining Balance Depreciation Calculator Sum Of The.

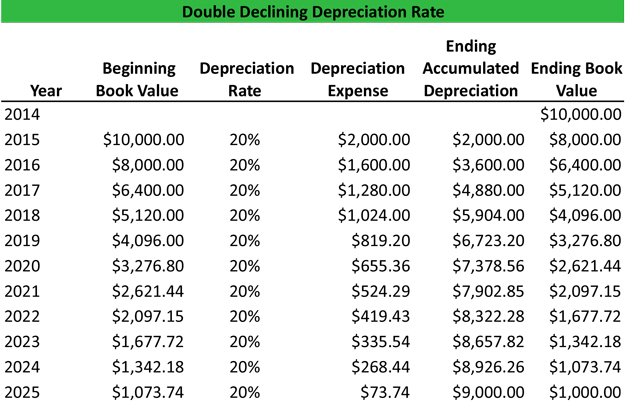

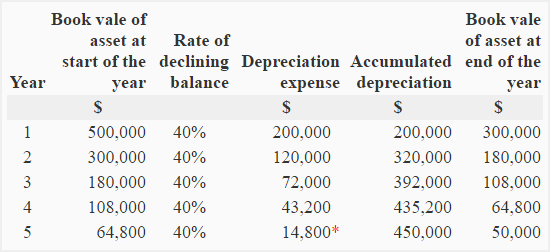

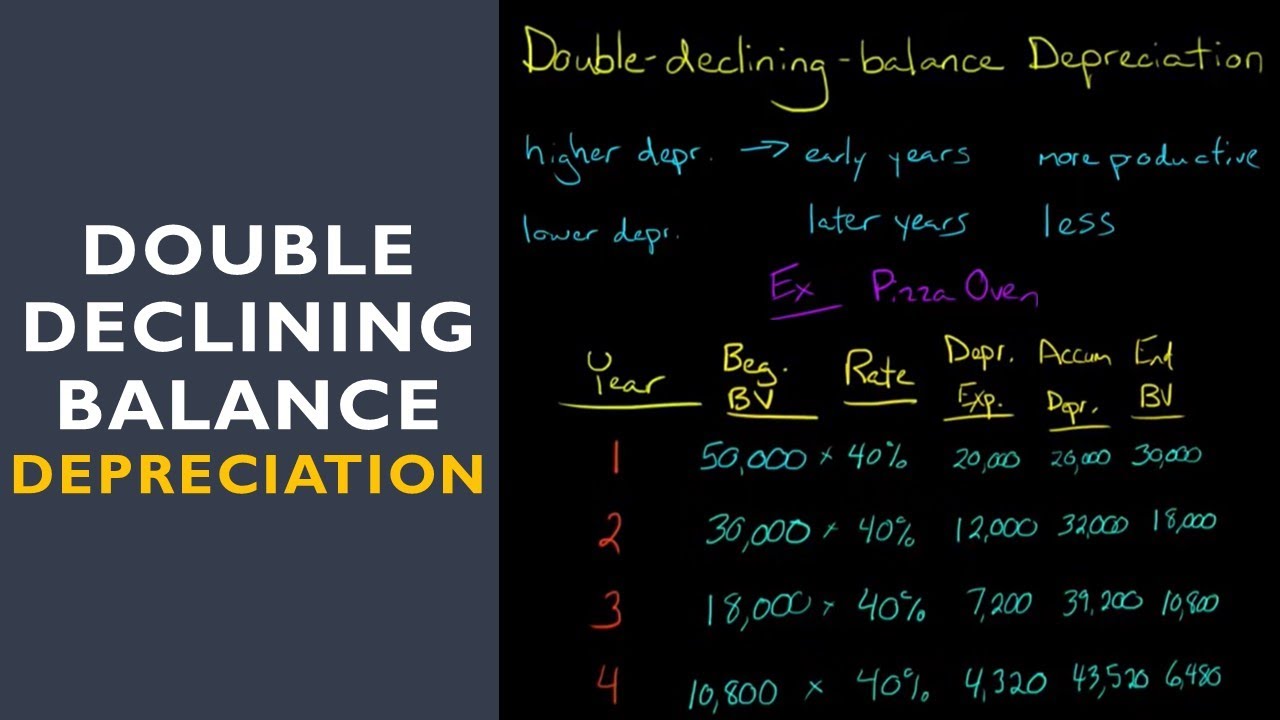

. The double declining balance formula. It is the rate through which the asset. However under the double declining balance method the 10 is doubled so that the vehicle loses 20.

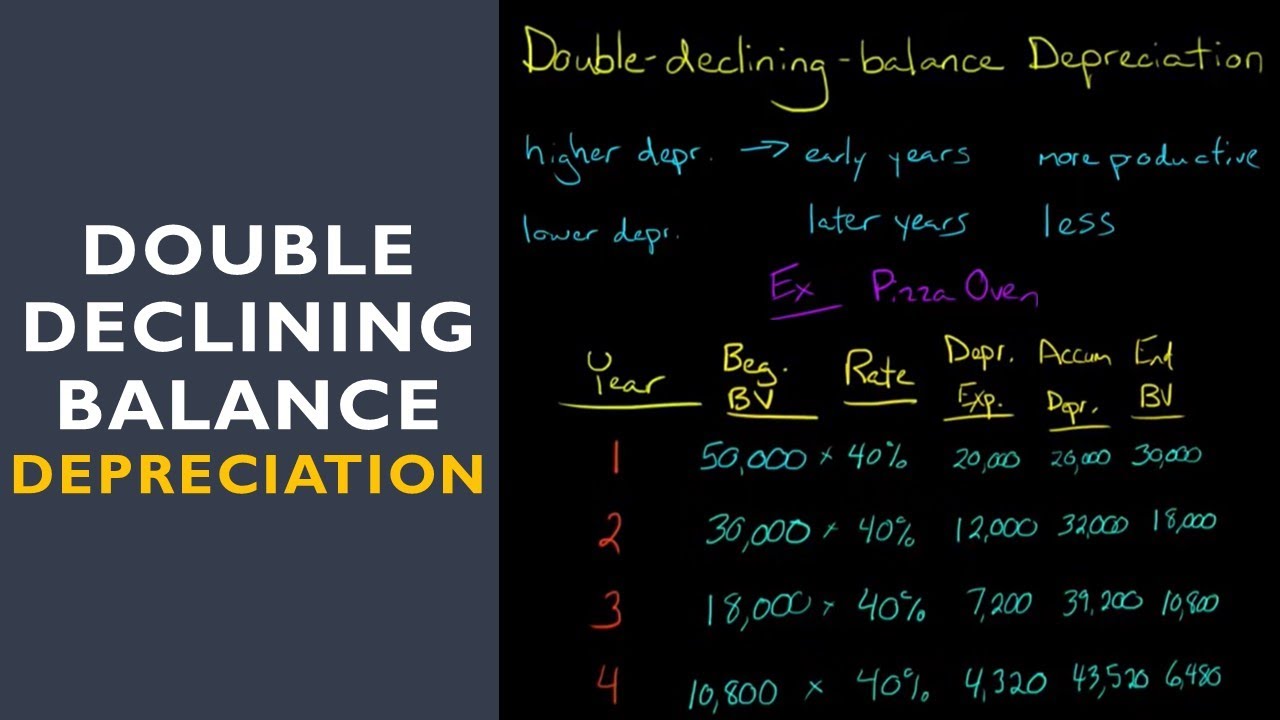

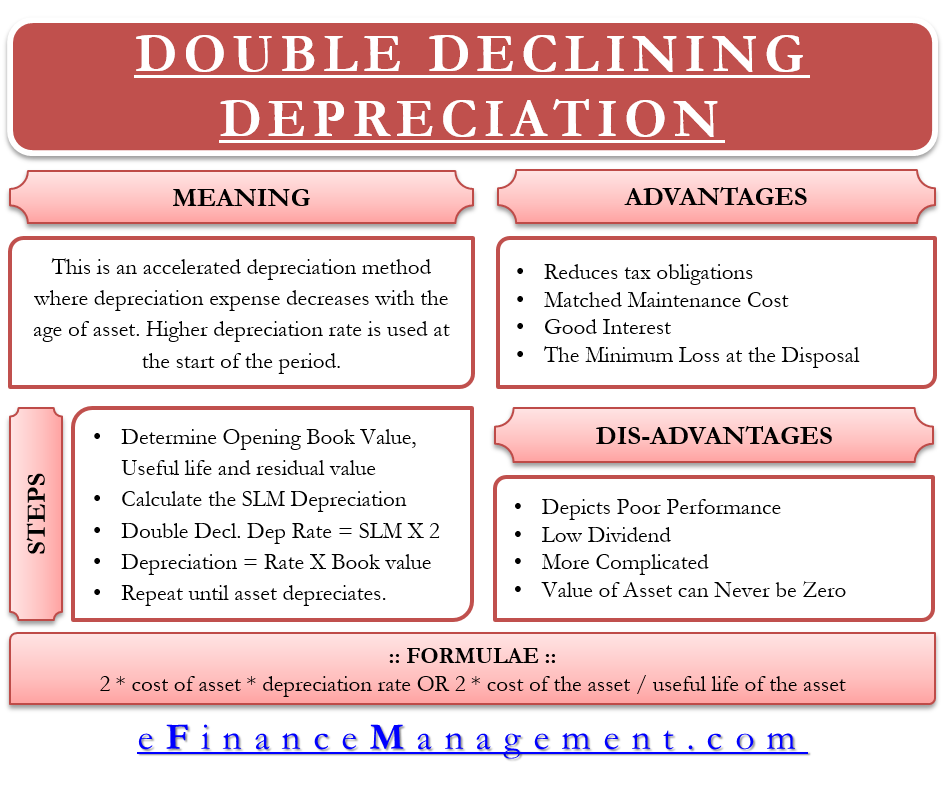

Double Declining Balance Method formula 2 Book Value of Asset at Beginning SLM. The double-declining balance method is an accelerated practice of depreciation in which most of the depreciation associated with an asset is recognized during the first few. Formula for Double Declining Balance Method.

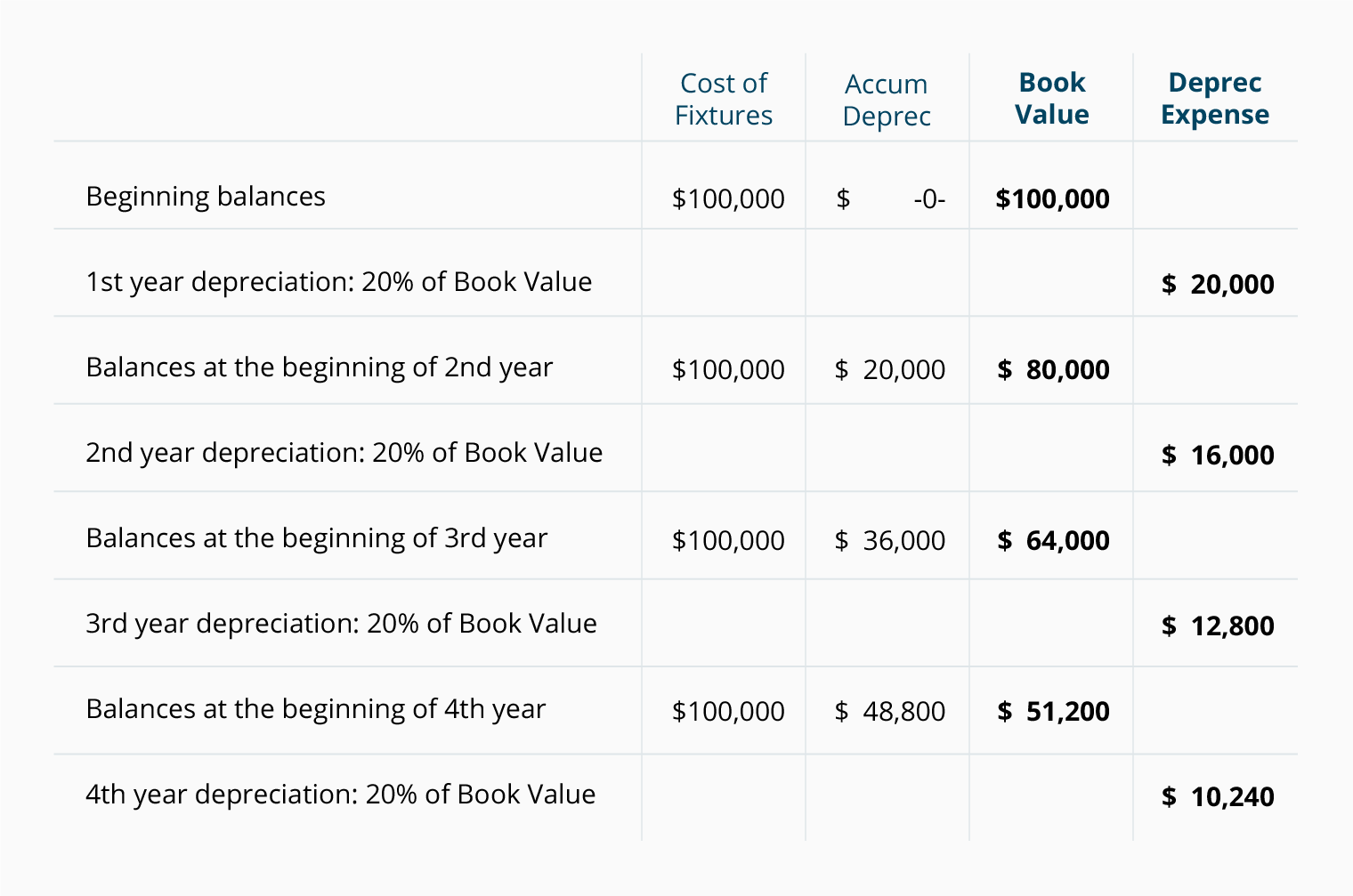

The double declining depreciation formula is defined quite simply as two times the straight-line depreciation rate multiplied by the book value of the asset. The double declining balance rate 2 x straight line depreciation rate. To consistently calculate the DDB depreciation balance you need to only follow a few steps.

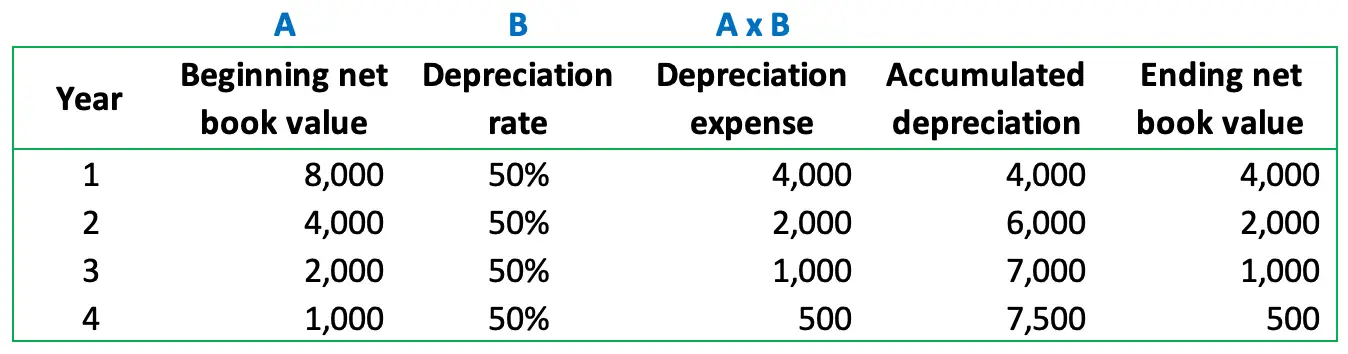

The double-declining balance method also called the 200 declining balance method is a common method for calculating accumulated depreciation or the value an asset. The Double Declining Balance Depreciation Method Formula. Double Declining Balance Depreciationdefined With Formula Calculation Examples.

Double declining balance depreciation is a method of quickly depreciating large business assets. Double declining balance rate 2 x 20 40. To implement the double-declining depreciation formula for an Asset you need to.

The DDB depreciation method is a little more. Let us see the meaning of each term separately. Double Declining Balance A Simple Depreciation Guide Bench Accounting 2 x 02 x 30000 12000 In the.

For other factors besides double use the Declining Balance Method. The book value of the. The formula for depreciation under the double-declining method is as follows.

Double Declining Balance Method formula 2. Double declining balance is calculated using this formula. 2 x basic depreciation rate x book value.

Double Declining Balance 2 Basic Rate of Depreciation Book Value.

Double Declining Balance Depreciation Calculator

What Is The Double Declining Balance Method Definition Meaning Example

What Is The Double Declining Balance Ddb Method Of Depreciation

Declining Balance Method Of Depreciation Definition Explanation Formula Example Accounting For Management

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Depreciation Efinancemanagement

Double Declining Balance Depreciation Method Youtube

Double Declining Balance Depreciation Daily Business

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach

Double Declining Balance Method Prepnuggets

Calculate Double Declining Balance Depreciation Accountinginside

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Simple Tutorial Double Declining Balance Method Youtube

Declining Balance Depreciation Double Entry Bookkeeping

Double Declining Balance Method Of Depreciation Accounting Corner

Depreciation Formula Examples With Excel Template